Play Net Worth: Cracking the Code to Musical Wealth

The music industry's allure extends beyond fame; it's a realm of significant financial potential. This article contrasts the financial trajectories of two vastly different musical acts: Coldplay, the global phenomenon, and Kid 'n Play, the innovative hip-hop duo. Their divergent paths illuminate essential strategies for achieving lasting financial security in the unpredictable music business, offering insights for artists, managers, and investors alike. For more examples, check out Emmylou Harris's net worth here.

Coldplay's Reign: A Global Empire of Sound

Coldplay's substantial net worth is the product of sustained effort, exceptional songwriting, and shrewd business decisions. Their monumental album sales have undoubtedly positioned them among the highest-earning bands ever. Their extensive global tours – each a significant revenue generator filling stadiums worldwide – further contribute to their immense income. Furthermore, their savvy merchandising strategy, encompassing apparel, posters, and other branded goods, consistently adds to their substantial revenue streams.

Beyond these prominent income sources, strategic financial planning likely plays a crucial role. A team of expert managers likely handles investments and long-term financial strategies, possibly including diversification into ventures beyond music. This calculated, multifaceted approach, combined with their undeniable musical talent, has cemented their status as financial powerhouses. How did they achieve such remarkable success? Strategic diversification and a keen business sense.

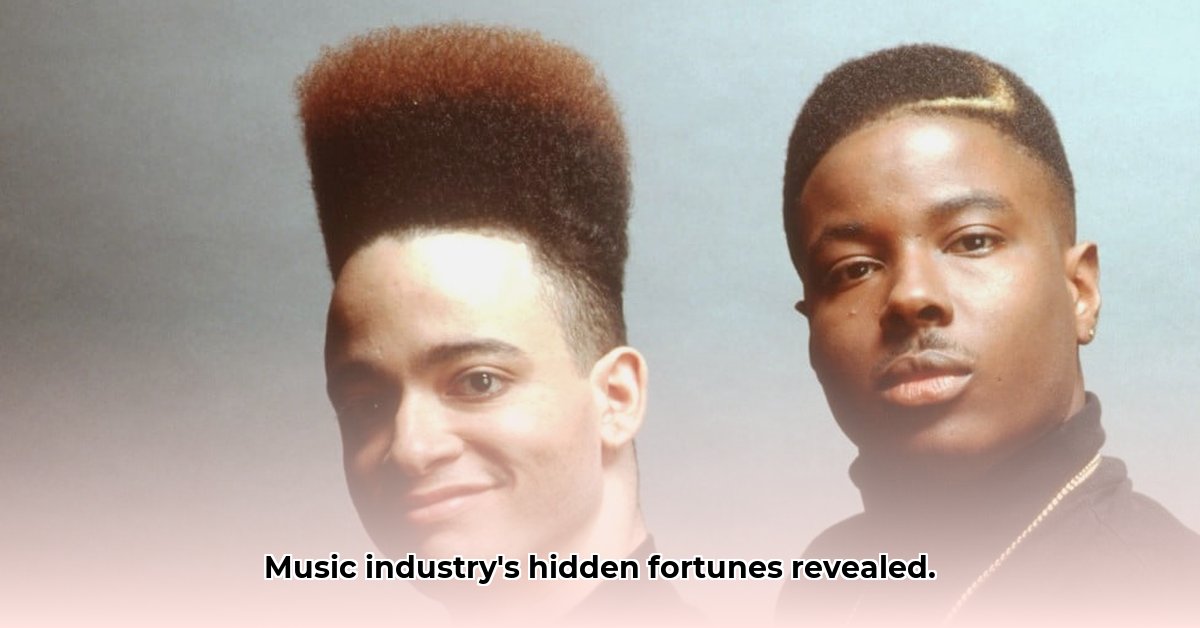

Kid 'n Play's Smart Moves: Diversification as a Winning Strategy

Kid 'n Play's journey exemplifies an alternative path to financial success in the music industry, demonstrating that global dominance isn't the sole route to wealth. While their music provided a strong foundation, their skillful diversification into other entertainment sectors proved crucial. Movie roles maintained high public visibility and generated considerable income. They further shrewdly leveraged brand partnerships and endorsements, building a resilient, multifaceted financial portfolio. Their story emphasizes the importance of adaptability and strategic decision-making.

Their net worth underscores the significance of expanding beyond core music-related ventures to create multiple income streams. This diversified approach creates a safety net against the music industry's inherent volatility, reducing dependence on fluctuating record sales or tour revenue.

The Power of Diversification: A Financial Safety Net

The core distinction between Coldplay and Kid 'n Play lies in their approaches to financial diversification. Coldplay's phenomenal early success provided the resources to invest significantly in their future, expanding their brand and securing their financial position. Kid 'n Play, while not achieving Coldplay’s global scale, constructed a robust foundation by strategically venturing into complementary entertainment areas. This demonstrates that enduring financial success isn't solely determined by a single metric, but by a carefully planned overall strategy. Both bands exemplify a pivotal understanding: sustainable financial stability in the entertainment world requires strategic planning beyond sheer talent.

The Elusive Net Worth: Understanding the Challenges

Precise net worth figures for musicians are notoriously elusive. While public data provides estimates, the true figures often remain confidential. Factors like publishing rights, future royalties from streaming services, and the dynamic valuation of their brands all complicate precise quantification. Therefore, while reasonable estimates can be made, determining exact net worths poses a significant challenge. Ongoing research is slowly improving our understanding of these complex financial dynamics, but substantial uncertainty remains.

Level Up Your Music Career: Actionable Steps for Success

The financial journeys of Coldplay and Kid 'n Play offer invaluable lessons for aspiring musicians and their management teams. Key takeaways include:

Craft a Powerful Brand: Your music is paramount, but your brand is your enduring asset. Cultivate a strong image and consistent message to maintain your presence in the market.

Multiple Income Streams: Don't rely solely on album sales. Explore live performances, merchandise, brand collaborations, and other avenues. Consider branching into related fields like film or writing.

Strategic Partnerships: Collaborate with other artists or businesses to broaden your reach and earning potential. Synergistic partnerships can significantly boost financial returns.

Master Your Finances: Develop financial literacy. Seek professional financial guidance to navigate tax laws, investment choices, and effective budgeting.

Long-Term Vision: A successful music career is a sustained effort, requiring strategic short-term and long-term financial planning.

Coldplay vs. Kid 'n Play: A Comparative Look

| Feature | Coldplay | Kid 'n Play |

|---|---|---|

| Main Revenue Sources | Global Tours, Album Sales, Merchandise | Music, Film, Brand Endorsements |

| Diversification Strategy | Moderate, focused on brand expansion | High, actively pursuing diverse revenue streams |

| Brand Recognition | Global | Strong niche following |

| Long-Term Approach | Consistent global success | Adaptable career leveraging opportunities |

| Estimated Net Worth | Substantially higher | Considerably lower, yet likely sustainable |

This comparison doesn't advocate for one path over the other. Instead, it highlights the diverse strategies leading to financial success in the music industry. Both acts underscore the crucial role of planning, adaptability, and identifying opportunities in building a lasting musical legacy and secure financial future. Your financial future begins with a well-defined plan today.

How to Diversify Income Streams for Musicians Like Kid 'n Play

Key Takeaways:

- Musicians require diverse income sources for financial stability. Relying on single income streams is inherently risky.

- Numerous avenues exist beyond traditional music sales and performances.

- Strategic planning is crucial for long-term financial success.

- Building a strong brand and maintaining strong fan engagement is paramount.

Beyond the Beats: Building a Multifaceted Music Empire

Kid 'n Play's success transcended catchy tunes; it was built on astute business decisions. They recognized that diversifying income required thinking beyond just record sales. Let's explore how you can build a similar empire. The key is to create multiple income streams beyond traditional methods.

Streaming: The Double-Edged Sword

Streaming offers vast reach, yet payouts remain notoriously low. To succeed, a large fanbase and effective promotion are essential. Consider:

- Platform Diversification: Don't concentrate your efforts on a single platform. Distribute your music across several platforms.

- Playlist Optimization: Understand the platform algorithms. Strategically place your music on relevant playlists to gain exposure.

- Fan Engagement: Actively interact with your audience. Cultivate a dedicated following.

Live Performances: The Immediate Gratification

Live performances offer immediate income and direct fan engagement. However, securing gigs and negotiating favorable contracts require effort. Effective strategies include:

- Networking: Attend industry events. Build connections with promoters and venue representatives.

- Marketing: Promote your shows effectively using social media and email marketing.

- Contract Negotiation: Develop skills in contract negotiation to secure beneficial agreements.

Merchandise: Building Brand Loyalty

Merchandising extends beyond simply selling t-shirts; it's about building and solidifying brand identity. It enhances fan loyalty and generates another income stream. Consider:

- Creative Merch: Think innovatively. Offer exclusive items fans will value and cherish.

- E-commerce Integration: Establish an online store for convenient purchasing.

- Limited Edition Items: Create a sense of scarcity to drive demand and value.

Sync Licensing: The Unexpected Revenue Stream

Licensing your music for films, TV, commercials, and video games is a lucrative but often overlooked avenue. However, it requires networking and persistence.

- Music Supervisor Networking: Connect with those responsible for selecting music for media projects.

- Targeted Music Creation: Compose with specific media genres in mind.

- Legal Counsel: Secure legal representation to safeguard your rights and earnings.

Passive Income: The Long Game

Passive income involves creating ongoing revenue streams without constantly active work.

- Online Courses: Share your musical expertise by offering online educational courses.

- Digital Products: Sell sheet music, backing tracks, or sample packs.

- Affiliate Marketing: Promote music-related products and earn commission on sales.

Strategic Diversification: The Kid 'n Play Approach

Approach your music career strategically. Don't rely on a single income source. Build diversified revenue streams to mitigate the inherent risks of the music industry. Following Kid 'n Play's example, you can create a lasting impact built on musical talent and business acumen.

Level Up Your Money Game: Gamified Personal Finance

For many, the mere mention of personal finance conjures images of spreadsheets, complicated jargon, and tedious budgeting. It’s often seen as a necessary but inherently dull chore, something to be endured rather than embraced. But what if managing your money could be as engaging and satisfying as your favorite video game? This is the core promise of gamified personal finance, a rapidly growing trend that aims to transform mundane financial tasks into an interactive and motivating experience. By borrowing elements from game design, this approach seeks to inject fun, challenge, and a sense of accomplishment into saving, investing, and spending wisely.

Imagine earning points for paying bills on time, unlocking badges for hitting savings goals, or competing with friends on a virtual leaderboard for the highest investment returns. Gamified finance apps and platforms incorporate features like progress bars that visually track your journey towards a debt-free life, virtual rewards for consistent saving habits, and personalized challenges designed to improve your financial literacy. These playful elements tap into our natural desire for achievement and recognition, making it easier to stay motivated, understand complex concepts, and build positive financial behaviors. The goal isn’t just to make finance less boring, but to empower individuals to take more active control of their financial future by making the path enjoyable and rewarding.